2017 January-March (Q1) Australian Motorcycles Sales Figures – Results by brand

Australian retail motorcycle sales data examined by Trevor Hedge

2017 Jan-March Road sales overview by brand – 2017 Jan-March Off Road sales overview by brand

Australian Motorcycle sales take a downturn in 2017

Quarterly sales figures released this week by the Federal Chamber of Automotive Industries indicate that there is very little joy for motorcycle distributors thus far in 2017. The Australian motorcycle market has taken a significant downturn.

Road bike sales are down 15.5 per cent, while off-road motorcycle sales are in a similar state, down 15.3 per cent.

Sportsbike sales continue their marked downturn but sales of learner bikes are still quite strong. An encouraging sign for the industry as a whole.

The scooter market continues to contract, down 22.3 per cent compared to the same three-month period in 2016.

ATV/SxS sales mainly held their ground, only down 1.3 per cent.

Total volume across all those sectors was 21,794 compared, with 25,160 units sold in the first quarter of 2016.

Which brands are shifting the most units?

Honda led the market overall with 4516 sales ahead of Yamaha’s 4094. Both brands were down 18 per cent overall.

Kawasaki is third with their road, off-road, ATV and scooter sales combining for a total of 2298, narrowly ahead of the 2261 roadbike only sales of Harley-Davidson.

KTM moved ahead of Suzuki in regards to total volume across all sectors, 2261 sales for the Austrian brand ahead of Suzuki’s 1710.

ATV speciailist Polaris is the next biggest brand in Australia ahead of Husqvarna. Husky climbed a number of spots on the charts to now rank as the eighth largest selling brand ahead of Triumph and BMW.

The 2017 sales tumble comes after what was a good 2016, in which the industry recorded its best annual result since 2009.

The full breakdown by brand across each segment is below, the first figure listed is the 2017 first quarter result, the second figure is for the same period in 2016, and the third figure is the percentage change.

We have also constructed pages with a detailed breakdown of sales by individual model segment with a study of those results found at the following links – Road Motorcycle Sales – Off Road Motorcycle Sales.

2017 Q1 Australian Overall motorcycle sales by brand

Manufacturer / 2017 sales / 2016 sales / % change

- Honda / 4516 / 5512 / -18.10%

- Yamaha / 4094 / 4995 / -18.00%

- Kawasaki / 2298 / 2684 / -14.40%

- Harley-Davidson / 2261 / 2286 / -1.10%

- KTM / 1723 / 1788 / -3.60%

- Suzuki / 1710 / 2395 / -28.60%

- Polaris / 1244 / 1139 / 9.20%

- Husqvarna / 675 / 507 / 33.10%

- Triumph / 658 / 704 / -6.50%

- BMW / 632 / 869 / -27.30%

- BRP Australia / 514 / 440 / 16.80%

- Ducati / 412 / 468 / -12.00%

- Piaggio / 293 / 291 / 0.70%

- Vespa / 240 / 284 / -15.50%

- Indian / 154 / 137 / 12.40%

- Others / 147 / 218 / -32.60%

- Victory / 95 / 59 / 61.00%

- Aprilia / 84 / 211 / -60.20%

- Moto Guzzi / 29 / 62 / -53.20%

- Hyosung / 9 / 52 / -82.70%

- Torino / 6 / 12 /

- Norton / – / 16 /

- Vmoto / – / 31 /

Top Ten Selling Motorcycles in Australia (excludes ATVs) – January-March 2017

- Honda NBC110 / 527 / -38.9%

- Harley Davidson FXSB / 352 / 15.8%

- Harley Davidson XG500 / 322 / -18.5%

- Honda GROM / 294 / 0.0%

- Yamaha YZF-R3A / 279 / -27.3%

- Kawasaki Ninja 300 / 268 / -40.8%

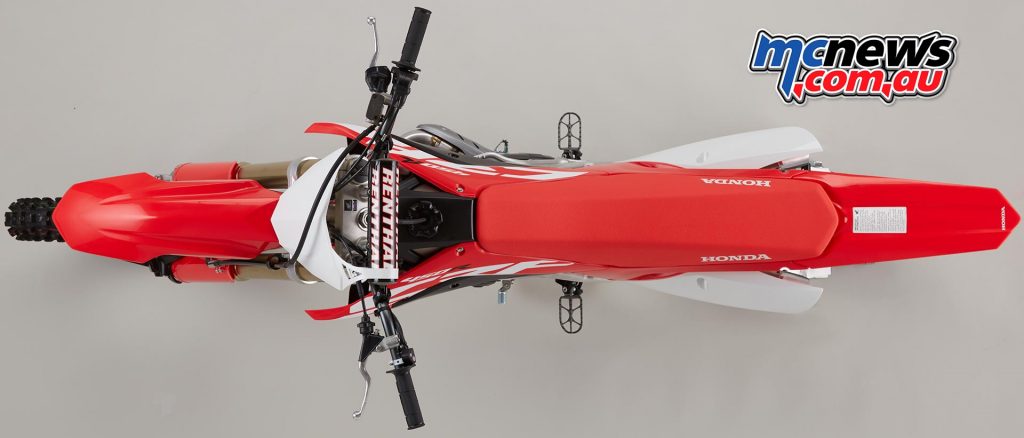

- Honda CRF450R / 260 / 176.6%

- Kawasaki KLX110 / 258 / 0.4%

- Harley Davidson VRSCDX / 254 / 48.5%

- Yamaha MT07L / 250 / -36.2%

2017 Q1 Australian Road sales by brand

Manufacturer / 2017 sales / 2016 sales / % change

- HD / 2261 / 2286 / -1.10%

- Honda / 1943 / 2377 / -18.30%

- Yamaha / 1455 / 1778 / -18.20%

- Kawasaki / 1097 / 1425 / -23.00%

- Triumph / 658 / 704 / -6.50%

- BMW / 618 / 851 / -27.40%

- Suzuki / 615 / 733 / -16.10%

- Ducati / 412 / 468 / -12.00%

- KTM / 330 / 429 / -23.10%

- Indian / 154 / 137 / 12.40%

- Victory / 95 / 59 / 61.00%

- Others / 76 / 116 / -34.50%

- Husqvarna / 65 / 54 / 20.40%

- Moto Guzzi / 29 / 62 / -53.20%

- Aprilia 19 / 89 / -78.70%

- Hyosung 9 / 52 / -82.70%

2017 Q1 Australian Off Road sales by brand

Manufacturer / 2017 sales / 2016 sales / % change

- Yamaha / 1734 / 2280 / -23.90%

- Honda / 1467 / 1836 / -20.10%

- KTM / 1393 / 1359 / 2.50%

- Kawasaki / 880 / 971 / -9.40%

- Husqvarna / 610 / 453 / 34.70%

- Suzuki / 601 / 989 / -39.20%

- Others / 40 / 56 / -28.60%

ATV Sales – Polaris continue to lead the way

Polaris again led the ATV segment with 1,244 sales. The North American brand was followed by Honda with 908 sales, with Yamaha a close third with 845 sales.

The Polaris Sportsman was #1 with 224 sales putting it comfortably ahead of Yamaha’s YFM450 which registered 139 sales to clinch second spot on the charts, ahead of Honda’s TRX500FM by just two sales.

Yamaha’s YFM350 was fourth ahead of the Honda TRX500FA.

2017 Q1 Australian ATV sales by brand

Manufacturer / 2017 sales / 2016 sales / % change

- Polaris / 1244 / 1139 / 9.20%

- Honda / 908 / 1015 / -10.50%

- Yamaha / 845 / 841 / 0.50%

- BRP Australia / 514 / 550 / 16.80%

- Suzuki / 388 / 553 / -29.80%

- Kawasaki / 321 / 288 / 11.50%

Top Ten Selling ATVs in Australia – January-March 2017

- Polaris Sportsman / 224 / 9.8%

- Yamaha YFM450FA/P / 139 / -22.3%

- Honda TRX500FM / 137 / -50.9%

- Yamaha YFM350F / 130 / 32.7%

- Honda TRX500FA / 122 / 67.1%

- Yamaha YFM700FB/P / 118 / 162.2%

- Yamaha YFM90R / 114 / 15.2%

- Suzuki LT-F300F / 94 / -6.0%

- Honda TRX420FM / 94 / -15.3%

- Yamaha YFM350 / 86 / -32.8%

Scooter Sales – 1013 scooters sold in the first quarter of 2017

Piaggio remained top-seller in the declining scooter market with 293 sales. Second place was taken by Vespa with 240 sales, and Honda third with 198 sales.

The top selling scooter model was the Piaggio Fly 150 with 97 sales placing it ahead of Suzuki’s Address which registered 88 sales.

2017 Q1 Australian Scooter sales by brand

Manufacturer / 2017 sales / 2016 sales / % change

- Piaggio / 293 / 291 / 0.70%

- Vespa / 240 / 284 / -15.50%

- Honda / 198 / 284 / -30.30%

- Suzuki / 106 / 120 / -11.70%

- Aprilia / 65 / 122 / -46.70%

- Yamaha / 60 / 96 / -37.50%

- Others / 31 / 46 / -32.60%

- BMW / 14 / 18 / -22.20%

- Torino / 6 / 12 / -50.00%

Top Ten Selling Scooters in Australia – January-March 2017

- Piaggio Fly 150 / 97 / -14.2%

- Suzuki ADDRESS / 88 / -9.3%

- Honda WW150 / 81 / -19.8%

- Piaggio ZIP 50 / 77 / 11.6%

- Vespa GTS 300 / 58 / -10.8%

- Vespa PRIMAVERA 150 / 54 / -1.8%

- Honda NSC110 / 53 / -48.5%

- Piaggio Typhoon 50 / 46 / -4.2%

- Vespa GTS 250 / 42 / 2.4%

- Honda MW110 / 41 / -18.0%

2017 Jan-March Road sales overview by brand – 2017 Jan-March Off Road sales overview by brand